When your child becomes old enough to drive, you may be worried about what this will do to your finances. How will having a new teen driver in the house affect your auto insurance policy? Bottom line: it’s going to cost you more. But how much more is not completely out of your control. There are some things your teenager can do to decrease how much more money you’ll have to pay.

What causes insurance rates to rise?

There are many reasons why a teenage driver on your policy can cause your insurance rates to rise. Statistically, they are some of the most at-risk drivers for insurance companies to cover. Teenagers are among the most dangerous drivers on the roads. They receive tickets and get into accidents at a rate several times greater than the average driver.

The ABC’s of Lowering Insurance Costs for Teen Drivers

Knowing how to curb some of the new expense of covering a teen driver is as simple as ABC.

- A A+ students save! You can help lower the amount of money a teen driver will add to your policy with every A your child makes in school. Their good grades can positively affect your auto insurance. Keep track of their good grades and keep your insurance agent informed.

- B Big & Boring vehicle: Did you know that the type of car or truck your teen drives will affect your auto insurance? Picking a safe, large and somewhat older vehicle versus a new, small sports car means you will pay less.

- C Clean driving record: Does your teen fully understand the rules of the road? Do they know the rules about where to park and how to avoid other traffic tickets? Each state has laws regarding restrictions for teen and novice drivers, including supervision, how late they can drive at night, and how many passengers are allowed in their vehicle during the first 6 months. Keeping a clean driving record is one of the best things your teen can do to keep your auto insurance costs down.

Typical Auto Insurance Rates for Teen Drivers in Kansas

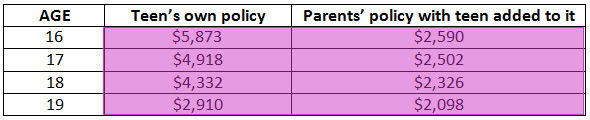

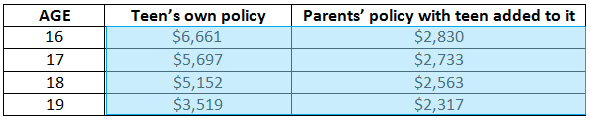

Each state has its own rates for teen drivers, and these rates are different for each age of the teenage years. While Kansas isn’t the most expensive state for teen drivers to be insured, it will definitely result in an increase you will notice on your bill.

It is less expensive for a teen to be on the parents’ policy versus getting their own policy. Why? When teens get their own insurance, they have less discounts available to them. Being added to their parents’ policy also means they will be listed as a secondary driver.

Refer to the below charts on the costs you can expect with a new teen driver. These charts list the average insurance costs and are separated by gender. Rates for teenage boys are higher than for girls.

AVERAGE RATES FOR A FEMALE TEENAGER

AVERAGE RATES FOR A MALE TEENAGER

When do you need to start auto insurance for your teenager?

You will want to start the process before they have gotten their learner’s permit. Most likely, your existing policy will cover them during this permit time. Then once they receive their license, your teenager will need to be added to your policy (or have a policy of their own). However, different insurers have different requirements regarding when new drivers need to be listed on an insurance policy.

Not sure what your policy requires?

Just give me a call before your teen gets their learner’s permit and I will make sure you are properly covered by your insurance policy in time. I work with all the major insurance companies and can also research to find out if a different company’s policy will save you money once you’ve added a teenage driver to your policy.